Doing Business in Australia doesn’t have to be hard

Armada Accountants & Advisors has eased the steps that will help you navigate the necessary compliance requirements to undertake business in Australia.

Our relationship with you is one of a partnership where we both work together to successfully launch your Australian Business Venture.

Let’s simplify the complicated and let you go about business whilst Armada handles the rest of your financial obligations.

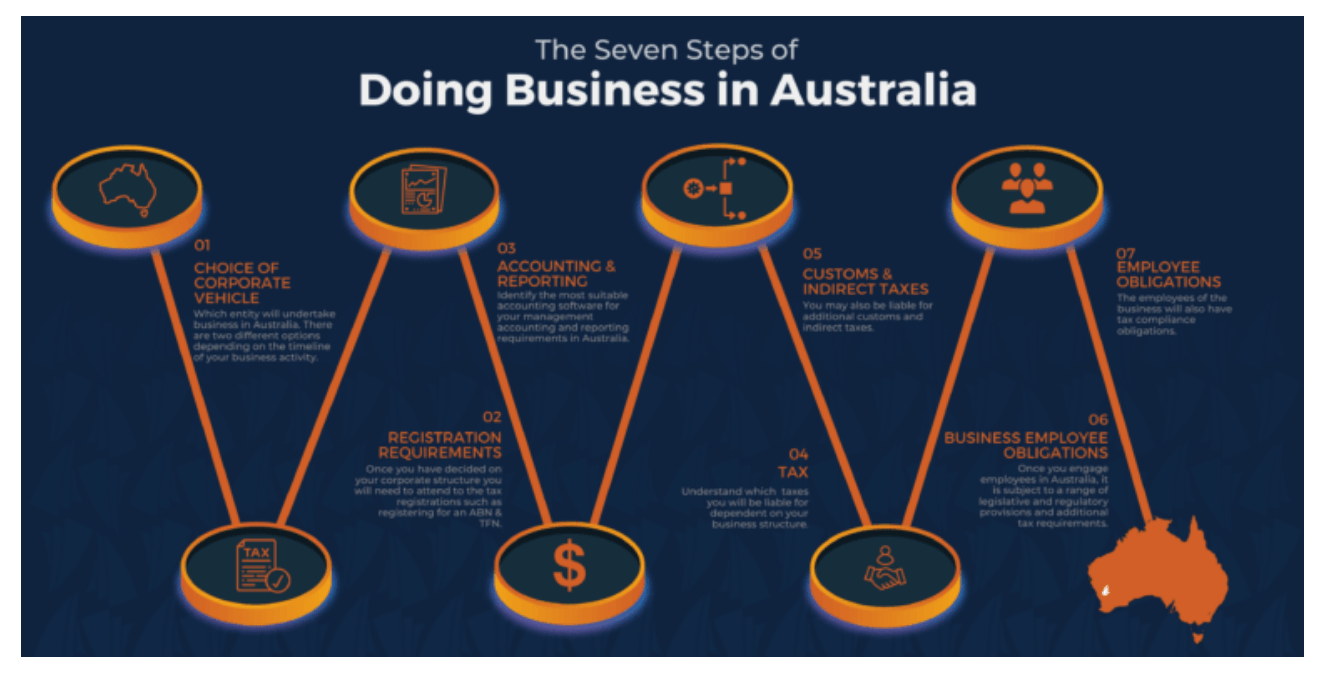

Our guide includes 7 simple steps that you need to be aware of when looking to either start or migrate your business into Australia. These steps cover things such as Registration Requirements, Accounting, Reporting, Tax & Obligations for both and Businesses and Employees. If you require specific advice or advice tailored to your business needs and industry, we have team of in house experts ready to meet with you either face-to-face, telephone, email or zoom to discuss your requirements.

In Australia, we are fortunate enough to enjoy established legal, financial, political and social systems along with high levels of vaccination rates and strong, stable employment growth. These factors make Australia an attractive option for international business owners, who are interested in migrating their businesses.

Why Should I Do Business in Australia?

✦ A Strong Economy

Australia’s Gross Domestic Product (at purchasing power parity) is in the top twenty countries in the world. The economy outperformed expectations during the pandemic. Until 2020, Australia had only experienced two years of negative growth during the previous 60 years.

Australia’s economy is 80% service-based, and we have a strong agricultural industry and a mining sector—both of which benefit from heavy demand from our neighbors in the Asia region. We are also lucky to have successful tourism and education sectors.

✦ Open Trade

Australia is a promoter of global free trade. We have several free trade agreements (FTAs) in place. Examples of FTA Australia currently have include Association of Southeast Asian Nations (ASEAN), China, Japan, South Korea, and the United States.

Iron ore, petroleum gas, gold, and aluminium oxide are among Australia’s main exports, with China India, Japan, South Korea, and the United States being key trade partners.

Frequently Asked Questions for Doing Business in Australia

When will I need to do my tax?

The Australian fiscal year runs from July 1 to June 30. Companies file an annual tax return for the financial year, however when you start your business in Australia you can request a different year end so that it aligns with your parent entity in your Business’s country of origin.

What business structures can you use to do business in Australia?

There are two main types of business structures that you can use to start your business in Australia:

- Company (public or private)

- Branch

Each structure has its own benefits and disadvantages. It is important to ensure you understand the differences between them, as each will their own tax, legal and compliance requirements.

What will I need to register for when setting up my Business in Australia?

If you derive Australian sourced income you will need to register to do business in Australia. You will be required to register for an Australian Business Number (ABN) and a Tax File Number (TFN). If you have a tax treaty, further research is required on the activity.

What taxes will I need to pay when Doing Business in Australia?

When Doing Business in Australia you may be liable to pay tax to the:

- Australian Federal Government,

- State/Territory Government, and

- Local Government.

Taxes your business may be liable for include:

- Income Tax

- Withholding Tax

- Goods and Services Tax (GST)

- Fringe Benefits Tax (FBT)

- Stamp Duty

What obligations will I have when hiring employees in Australia?

International business owners employing people in Australia need to be aware of employment obligations, such as:

- Pay As You Go (PAYG) Withholding Tax

- Fringe Benefits Tax (FBT)

- Superannuation Guarantee Charge (SGC)

- Workers Compensation

- Occupation Health and Safety National Employment Standards

Depending on the state or territory your business is located in, you may have additional employee obligations.

If you are interested in learning more about how Armada can assist you with Doing Business in Australia, please check out our Guide to Doing Business in Australia.

There are many more resources you can access for information regarding Doing Business in Australia. The Australian Trade and Investment Commission provide details on setting up a business in Australia, investing in an Australian business and listing a Business on the Australian Stock Exchange.