With the collapse of several businesses in the housing and construction industry recently—due to COVID impacts and supply chain shortages—with more tipped to collapse over the coming months, there has been increased demand for business restructuring information and advice.

In January 2021, the Government made changes to Australia’s insolvency framework for small businesses. These changes better serve businesses, their employees and their creditors.

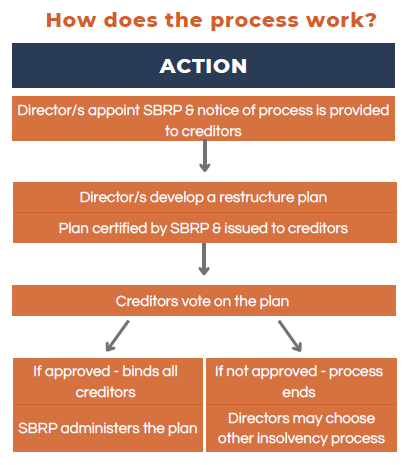

The Small Business Restructuring Process (“SBRP”) is designed to help businesses restore operational liquidity by removing the burden of legacy debts through a formal debt compromise with creditors.

Key Features:

- Director/s remain in control & continue to trade;

- Cost effective;

- Streamlined debt restructuring process; SBRP does not manage company; and SBRP able to terminate plan.

- Unlike other restructuring procedures, the SBRP allows for Company Directors to remain in control of and continue to operate their business as normal during the restructuring period.

Companies wishing to utilise this process must meet the following criteria:

- Less than $1 million in liabilities (excluding liabilities to employees);

- All outstanding employee entitlements, including superannuation, must have been paid (not including entitlements not yet due for payment, e.g. annual or long service leave); and

- All company tax lodgements must be up to date.